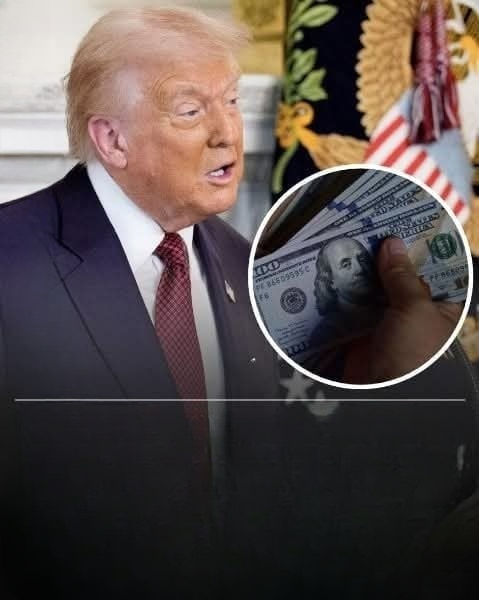

In the evolving landscape of American economic policy, few proposals generate as much public discussion as those involving taxes, tariffs, and direct payments to citizens. Recently, former President Donald Trump ignited a new wave of national conversation with a sweeping plan he shared on Truth Social — a proposal centered on using tariff revenue to create what he referred to as a “national dividend.”

According to his statement, this dividend would provide at least $2,000 per eligible adult, with high-income households excluded from the program. The announcement immediately captured media attention, sparked debate among economists, and raised numerous questions about feasibility, implementation, and potential economic impact.

While the idea of tariffs funding a universal payout is far from new, Trump’s strong endorsement of the approach brought the concept back into mainstream economic discussion. But what exactly does the plan involve? How would it work? And what are the potential benefits and challenges of such a nationwide program?

This long-form article breaks down the proposal in detail, explores the theoretical mechanics of tariff-funded dividends, analyzes expert reactions, and considers what such a plan could mean for American households, businesses, and long-term economic stability.

A New Vision Shared on Social Media

Trump’s message was brief but bold. In a post to his followers, he claimed his administration would implement a nationwide dividend using money collected from tariffs on imported goods. He emphasized that every qualifying American adult would receive a minimum of $2,000, framing the plan as both a financial boost for citizens and a strategy to strengthen the country’s economic position.

The post stated:

“A dividend of at least $2,000 per person (excluding high-income earners) will be paid to everyone.”

The simplicity of the promise — tax foreign imports, collect revenue, give money back to Americans — immediately resonated with segments of the public who have long supported ideas like universal basic income (UBI), tax rebate programs, or expanded government stimulus initiatives.

However, the proposal also raised questions:

-

How much revenue would tariffs actually produce?

-

Would tariff revenue be sufficient to cover such a large program?

-

How would payments be delivered?

-

Who counts as “high-income,” and where is the eligibility cutoff?

-

Would tariffs raise consumer prices?

-

Could this create unintended ripple effects for businesses and workers?

Despite these uncertainties, Trump expressed strong confidence in the concept and used forceful language to defend tariffs as a tool for national prosperity.

Trump’s Argument: Tariffs as a Tool for National Strength

In his social media post, Trump reiterated a long-standing position: that tariffs are not simply taxes on goods but powerful instruments that can strengthen American industries and generate substantial federal revenue. He wrote:

“People that are against tariffs are FOOLS! We are now the richest, most respected country in the world, with almost no inflation, and a record stock market price.”

This assertion reflected his broader economic philosophy — that the United States, when assertive in trade policy, can leverage its massive consumer market to encourage foreign countries to renegotiate trade deals, shift production, or absorb the financial burden of higher import costs.

Trump’s supporters argue that tariffs:

-

Protect American jobs

-

Encourage domestic manufacturing

-

Reduce dependency on foreign goods

-

Generate revenue that could be returned to U.S. citizens

Critics, however, have historically raised concerns that tariffs can lead to higher consumer prices, strained international relationships, and increased costs for businesses that rely on imported materials.

Trump’s proposal revives these long-standing debates but adds a new twist — using tariff income directly to fund a nationwide dividend.

Understanding the Core Component: A “National Dividend”

The concept of a national dividend is not entirely new. Versions of the idea have appeared in discussions surrounding universal basic income, stimulus programs, and Alaska’s Permanent Fund Dividend, which distributes oil revenue to state residents.

Trump’s version is different in several key ways:

-

The funding source is tariffs, not corporate taxes, oil revenue, or general federal taxation.

-

The amount is described as at least $2,000 per person per payment cycle, though the frequency is unclear.

-

Eligibility limitations would exclude high-income Americans, suggesting a means-tested approach.

-

No formal structure has been outlined — meaning the program exists only conceptually at this stage.

Still, the idea of returning tariff revenue directly to the public is not without precedent in policy discussions. Several economic models have explored “carbon dividends,” for example, where revenue from carbon taxes is redistributed to citizens.

The key difference: tariffs fluctuate significantly year to year, depending on trade volume, global supply chains, consumer behavior, and foreign policy decisions.

Thus, a central question becomes: can tariff revenue reliably sustain a program of this magnitude?

How the Plan Might Work — In Theory

Although Trump’s announcement did not include a formal framework, it is possible to explore how such a plan could be implemented, based on existing government systems and economic models.

Step 1: Tariff Collection

Tariffs are taxes placed on imported goods. The U.S. currently collects tens of billions in tariff revenue annually. Under a more aggressive tariff strategy, this number could rise significantly.

Step 2: Revenue Allocation

Instead of funneling tariff revenue into the general federal budget, the government would earmark it specifically for dividend payments.

Step 3: Eligibility Criteria

Trump mentioned that high-income individuals would be excluded. This suggests:

-

A possible annual income threshold

-

A system similar to stimulus-check eligibility

-

Use of IRS data to verify who qualifies

This becomes a politically sensitive area, given differing opinions on what counts as “high income.”

Step 4: Payment Distribution

Trump referenced no official method, but two obvious possibilities are:

-

Tax rebates

-

Healthcare-related credits

Alternatively, payments could be made directly through Treasury disbursements, much like stimulus payments during the COVID-19 pandemic.

Step 5: Oversight and Adjustments

Because tariff revenue fluctuates, the government may need:

-

Reserve funds

-

Adjustable payment amounts

-

Automatic mechanisms to pause or reduce dividends during low-revenue periods

None of this has been clarified, leaving significant policy gaps.

Would Tariff Revenue Be Enough?

To understand feasibility, it is necessary to examine how much revenue tariffs actually generate.

Recent Data

In recent years, U.S. tariffs have generated between $70 billion and $100+ billion annually, depending on policies in place.

If each eligible American received a $2,000 payment, and assuming roughly 240 million adults reside in the U.S., the total annual cost would exceed $400 billion — far exceeding current tariff income.

This means one of the following must happen:

-

Tariffs must be increased dramatically

-

New categories of goods must be taxed

-

Payments must be less frequent (e.g., once every few years)

-

Fewer people must qualify

-

The government must supplement tariff revenue from other sources

Critics argue that heavy reliance on tariffs could raise consumer prices and strain supply chains, while supporters contend that foreign exporters would shoulder much of the financial burden.

Economic Disagreement and Public Debate

Economists remain sharply divided over tariff-funded dividend proposals.

Arguments in Favor

Supporters highlight:

-

Direct payments help stimulate the economy

-

Families benefit from additional financial security

-

Foreign competitors contribute to U.S. domestic welfare

-

Tariffs incentivize companies to move production to the United States

Some compare the idea to the Alaska dividend system, where resource revenue is redistributed to residents.

Arguments Against

Critics warn:

-

Tariffs can raise costs for American consumers

-

Businesses may suffer if supply prices increase

-

Retaliation from international trading partners may occur

-

Tariff revenue is too unstable to fund guaranteed payments

-

Such a plan could expand inflation if not carefully structured

Some economists describe the plan as “ambitious but unpredictable,” noting that tariff revenue is highly sensitive to global market conditions.

Lack of Specifics Raises Questions

While Trump’s announcement generated widespread attention, the absence of a detailed plan leaves many unanswered questions.

1. How often would people receive payments?

Monthly? Yearly? One-time? The message did not specify.

2. Who decides the definition of “high income”?

During previous stimulus programs, income limits ranged from $75,000 to $100,000 per year for individual filers. Trump’s dividend could use similar thresholds — or create entirely new ones.

3. Would tariffs increase consumer prices?

Economists disagree, but many argue that higher import taxes often lead to higher consumer costs.

4. How would the government handle revenue fluctuations?

Years with lower import volume could cause payment delays unless reserve systems were implemented.

5. Would businesses face new challenges?

Companies relying on imported materials or equipment could see increased costs, which may affect workers or consumers.

These unanswered questions fuel debate and make the proposal one of the most talked-about economic ideas of the year.

Broader Political and Economic Context

Trump’s announcement does not exist in isolation. It follows wider discussions in American politics about:

-

Universal Basic Income (UBI)

-

Tax rebates

-

Inflation relief payments

-

Stimulus checks

-

Cost-of-living concerns

-

Trade competition with China

By framing his proposal around tariffs rather than new taxes, Trump positions the plan as a way of redistributing revenue from foreign exporters to American families.

Supporters see it as an innovative approach. Critics call it unrealistic or incomplete. Either way, it has undeniably re-energized conversations about how the government can support citizens financially.

Potential Impact on the Average American Household

If implemented successfully, a $2,000 dividend could provide meaningful benefits:

-

Families could use the payments for necessities

-

Lower-income households could experience improved stability

-

The money could stimulate local economies

-

Savings and emergency funds could grow

-

Citizens might gain a sense of shared economic participation

However, if the plan inadvertently raised consumer prices through tariffs, some households might see mixed results.

Thus, the impact would depend heavily on the structure, safeguards, and long-term management of the program.

Historical Comparisons and Lessons Learned

Tariffs have been used in U.S. history for various purposes, including:

-

Funding the early federal government

-

Protecting industry

-

Influencing trade relationships

-

Responding to foreign competition

Yet, never before have tariffs been proposed as a primary funding mechanism for universal payments.

Several past experiments offer relevant lessons:

Alaska’s Dividend

Funded by oil revenue, not tariffs — but demonstrates that resource-based revenue can support public payouts when properly managed.

COVID-19 Stimulus Checks

Show that mass payments can be distributed quickly and efficiently through the IRS.

Trade Conflicts with China

Reveal how tariff policies can trigger retaliatory measures and supply chain disruptions.

These experiences highlight both the potential and pitfalls of large-scale economic programs.

Public Reaction and Ongoing Discussion

Following Trump’s post, social media, news outlets, and economic forums lit up with reactions:

-

Supporters applauded the idea

-

Critics questioned the math

-

Economists debated feasibility

-

Policy analysts pointed to missing details

The conversation continues to evolve as more people weigh in on what such a plan could mean for America’s economic future.

A Growing Debate About the Future of National Dividends

Regardless of political affiliation, many Americans agree on one thing: direct payments during economic hardship proved helpful for millions. As a result, the idea of recurring dividends — whether tariff-based, tax-based, or resource-based — is gaining attention.

Trump’s proposal, though still abstract, pushes this conversation further into the mainstream and forces policymakers to confront broader questions:

-

Should the government create permanent economic dividends?

-

Where should funding come from?

-

Who should qualify?

-

How can these programs avoid inflationary effects?

These discussions will likely continue long after the initial announcement.

Conclusion: A Proposal That Opens the Door to Bigger Conversations

Trump’s tariff-funded dividend proposal remains in its earliest conceptual stage. While bold and attention-grabbing, it lacks the specifics necessary to determine viability. Still, its release has accomplished one important thing: it has reignited national debate about how the government can support citizens, how trade policy affects domestic life, and whether dividend-style programs could become a permanent part of America’s economic landscape.

Whether or not the proposal becomes policy, it has already pushed a larger conversation into the spotlight — one centered on fairness, financial stability, resource distribution, and the future of economic policy in a rapidly changing world.

And at a time when many Americans are concerned about rising costs, economic uncertainty, and global competition, that conversation may prove more important than the proposal itself.