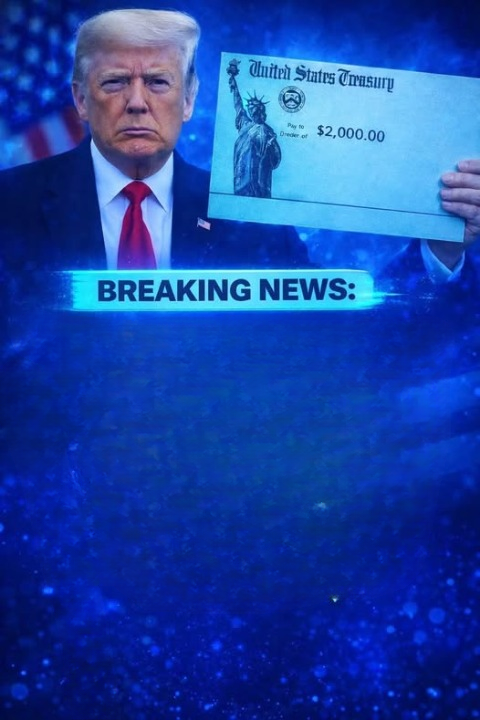

In recent political discussions, former U.S. President Donald Trump has once again sparked national attention by proposing an ambitious economic idea. Through a post on the social media platform Truth Social, Trump outlined a concept that centers on the use of tariffs to generate government revenue, with a portion of that revenue redistributed directly to American citizens in the form of a dividend. The proposal suggests payments of at least $2,000 per eligible person, excluding individuals classified as high-income earners.

The idea has drawn interest, debate, and questions from economists, policymakers, and everyday Americans alike. Supporters see it as a bold approach to rewarding citizens while protecting domestic industries. Critics, however, raise concerns about inflation, international trade relations, and the long-term sustainability of such a program. This article explores the proposal in depth, breaking down how it might work, what it aims to achieve, and the challenges it could face if implemented.

Understanding the Core Proposal

At its foundation, the proposal revolves around a simple concept: impose tariffs on imported goods, collect revenue from those tariffs, and redistribute part of that income to the American public. Trump described the plan as a way to ensure that the benefits of international trade policies flow directly to citizens rather than remaining solely within government budgets or corporate profits.

According to Trump’s statement, the dividend would be substantial, with payments starting at a minimum of $2,000 per person. However, the plan specifies that high-income earners would be excluded, suggesting a targeted distribution approach rather than a universal payout.

This concept resembles dividend-style programs used in other contexts, such as resource-based revenue sharing, though on a much larger and more complex national scale.

The Role of Tariffs in Economic Policy

Tariffs are taxes imposed on imported goods and services. Governments often use them to protect domestic industries, encourage local production, or respond to trade imbalances. In the past, tariffs have been a common tool in U.S. economic policy, though their use has varied depending on political priorities and global economic conditions.

Under Trump’s proposal, tariffs would serve a dual purpose. First, they would discourage excessive reliance on foreign imports, potentially strengthening domestic manufacturing. Second, they would generate a steady stream of revenue that could be partially returned to citizens.

Trump has consistently argued that tariffs place the financial burden on foreign producers rather than American consumers. Critics, however, often point out that import taxes can lead to higher prices, as businesses may pass costs along to consumers.

Revenue Generation and Redistribution

One of the central questions surrounding the proposal is whether tariffs could realistically generate enough revenue to support a nationwide dividend program. A payout of $2,000 per eligible person would require hundreds of billions of dollars annually, depending on eligibility criteria and population size.

Supporters argue that expanded tariffs on a wide range of imported goods could create sufficient income, particularly if trade volumes remain high. They also suggest that additional economic growth resulting from stronger domestic production could further increase tax revenues.

Skeptics counter that tariffs alone may not produce the consistent and reliable funding needed for such a large-scale program. They warn that reduced imports, trade retaliation, or changes in consumer behavior could significantly affect revenue levels.

Eligibility and Income Exclusions

The proposal indicates that high-income earners would not receive the dividend, though no specific income threshold has been defined. This raises important questions about how eligibility would be determined and enforced.

Means-tested programs require detailed income verification, which can increase administrative costs and complexity. Determining who qualifies, how often eligibility is reviewed, and how to handle changes in income would all need to be addressed through legislation and regulatory frameworks.

Excluding high-income individuals may make the program more politically acceptable to those who favor targeted assistance, but it could also reduce public support among groups who view universal benefits as simpler and fairer.

Possible Distribution Methods

While the proposal promises a dividend, it does not specify how payments would be delivered. Several options have been discussed by analysts and commentators:

-

Direct Cash Payments

The most straightforward method would be direct deposits or mailed checks, similar to past stimulus payments. This approach provides flexibility, allowing recipients to use funds as they see fit. -

Tax Rebates or Credits

Another possibility is distributing the dividend through the tax system, either as refundable credits or annual rebates. This method could reduce administrative duplication but may delay access to funds. -

Healthcare or Social Benefit Credits

Some have suggested applying the dividend toward healthcare costs, insurance premiums, or other essential services. While this could target specific needs, it would limit individual choice.

Each method carries its own advantages and drawbacks, and selecting one would require careful consideration of efficiency, equity, and public perception.

Economic Arguments in Favor of the Plan

Supporters of the tariff-funded dividend highlight several potential benefits. They argue that returning tariff revenue directly to citizens could offset any price increases caused by import taxes. In this view, consumers would effectively receive compensation for higher costs, preserving purchasing power.

Additionally, proponents believe the plan could strengthen national economic confidence. A visible dividend payment may increase public support for trade policies and foster a sense of shared national prosperity.

Trump has also emphasized broader economic indicators, such as strong stock market performance and low inflation during certain periods, as evidence that his economic approach can deliver positive results.

Concerns About Inflation and Consumer Prices

One of the most common criticisms of tariff-based policies is their potential impact on inflation. When imported goods become more expensive due to tariffs, businesses may raise prices to maintain profit margins. This can affect a wide range of products, from electronics to household items.

If prices rise significantly, the purchasing power of a dividend payment could be reduced. Economists caution that without careful calibration, the policy could create a cycle where consumers receive payments but face higher living costs.

Managing inflation would therefore be a critical challenge for any administration attempting to implement such a plan.

International Trade Implications

Tariffs often influence international relationships. Trading partners may respond with their own tariffs, leading to trade disputes or reduced export opportunities for American businesses. Such retaliatory measures could affect industries that rely heavily on global markets.

Supporters of the proposal argue that a strong domestic economy can withstand these challenges and that renegotiated trade terms could ultimately benefit the United States. Critics, however, warn that prolonged trade tensions could disrupt supply chains and harm long-term economic growth.

Balancing national interests with global cooperation would be essential to minimizing negative outcomes.

Administrative and Legal Challenges

Implementing a nationwide dividend program would require extensive administrative infrastructure. Federal agencies would need systems to track eligibility, process payments, prevent fraud, and resolve disputes.

Legal considerations would also play a role. New legislation would be required to authorize tariffs at the necessary levels and allocate revenue for direct payments. Lawmakers would need to address constitutional questions, budgetary constraints, and oversight mechanisms.

The complexity of these processes underscores the importance of detailed planning and bipartisan cooperation.

Comparisons to Other Dividend Models

While the proposed plan is unique in scale, it shares similarities with other dividend programs. For example, some regions distribute revenue from natural resources directly to residents. These programs demonstrate that dividend-style payments can be administratively feasible, though they typically rely on stable and predictable income sources.

Applying a similar model at the national level, funded by tariffs rather than natural resources, introduces additional uncertainty due to fluctuating trade volumes and global economic conditions.

Public Opinion and Political Feasibility

Public reaction to the proposal has been mixed. Some Americans welcome the idea of direct financial benefits tied to national economic policy. Others express skepticism, questioning whether the plan is realistic or sustainable.

Political feasibility would depend on legislative support, public trust, and economic conditions at the time of implementation. Election cycles, party priorities, and shifting public sentiment could all influence the proposal’s future.

Long-Term Economic Considerations

Beyond immediate impacts, the proposal raises questions about long-term economic strategy. Would reliance on tariffs encourage domestic innovation and investment, or could it lead to inefficiencies and reduced competitiveness?

Economists emphasize the importance of adaptability. Any large-scale policy must be flexible enough to respond to changing economic conditions, technological advancements, and global trends.

A dividend program tied to tariffs would need mechanisms to adjust payment levels, tariff rates, and eligibility criteria over time.

Transparency and Accountability

For the plan to gain widespread acceptance, transparency would be essential. Citizens would likely want clear explanations of how much revenue is collected, how funds are allocated, and how decisions are made.

Regular reporting, independent audits, and public oversight could help build confidence in the program. Without these safeguards, skepticism and opposition could grow.

Potential Social Effects

Direct payments can have social implications beyond economics. They may reduce financial stress, support household stability, and encourage consumer spending. However, critics sometimes argue that regular payments could discourage workforce participation, though evidence on this issue remains mixed.

Designing the program to complement, rather than replace, existing economic incentives would be crucial.

The Need for a Clear Framework

One of the most significant gaps in the proposal is the absence of a detailed framework. Key questions remain unanswered, including:

-

How high would tariffs need to be?

-

Which goods would be affected?

-

How often would dividends be paid?

-

How would eligibility be verified?

Without clear answers, the proposal remains a concept rather than a fully developed policy.

Conclusion

Donald Trump’s proposal to fund a nationwide dividend through tariffs represents a bold and unconventional approach to economic policy. By linking trade measures directly to citizen benefits, the idea aims to reshape how Americans experience national economic decisions.

While the concept has potential advantages, including increased public engagement and direct financial support, it also faces significant challenges. Economic uncertainty, administrative complexity, and international trade dynamics all present obstacles that would need careful management.

Ultimately, the success of such a plan would depend on detailed planning, transparent implementation, and ongoing evaluation. As with any major policy initiative, informed public discussion and rigorous analysis will be essential in determining whether this vision can move from idea to reality.