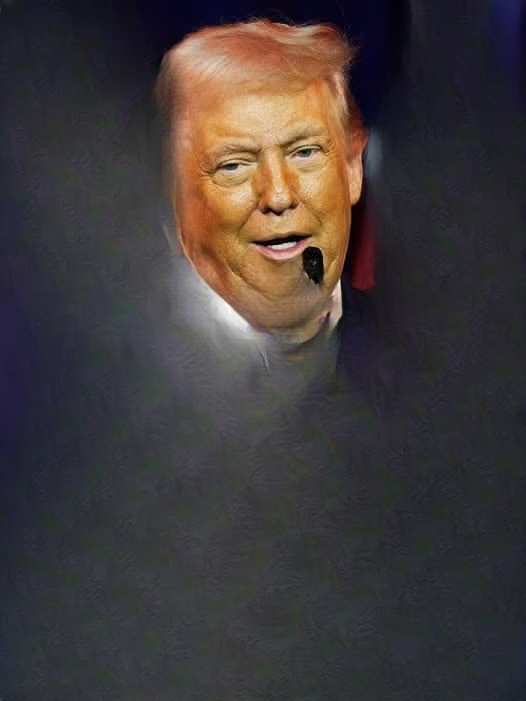

Former President Donald Trump recently drew renewed attention to economic policy discussions after sharing a proposal on his social media platform, Truth Social, suggesting that revenue generated from tariffs could be used to fund a nationwide dividend for Americans. The idea centers on redirecting income from taxes on imported goods back to U.S. residents in the form of direct financial benefits.

According to Trump’s statement, the proposal envisions payments of at least $2,000 per person, with eligibility excluding individuals above certain income thresholds. While the idea has sparked interest among supporters, it has also raised questions among economists, policymakers, and the public regarding feasibility, economic impact, and implementation.

At this stage, the proposal remains conceptual rather than legislative, with no formal policy framework or congressional action attached to it.

The Core Concept Behind the Proposal

The underlying premise of the plan is relatively simple in theory. Tariffs—taxes imposed on imported goods—would generate revenue for the federal government. A portion of that revenue would then be redistributed directly to Americans in the form of a dividend or rebate.

Supporters of the idea argue that this approach could allow the United States to benefit financially from international trade while providing tangible relief to households. The concept is sometimes framed as ensuring that economic gains from trade policy are shared more directly with the public.

Trump characterized tariffs as a tool not only for trade negotiation but also for strengthening domestic finances. In his statement, he suggested that tariffs could help bolster national wealth while supporting everyday Americans.

Tariffs and Their Economic Role

Tariffs have long been a component of U.S. trade policy, used for a variety of purposes including protecting domestic industries, responding to trade imbalances, and encouraging negotiations with foreign governments. When tariffs are imposed, importers typically pay the tax, though the economic effects can ripple through supply chains.

Economists often note that tariffs can have mixed outcomes. On one hand, they can raise government revenue and provide protection for certain domestic producers. On the other hand, they may contribute to higher prices for consumers and businesses that rely on imported goods.

The effectiveness of tariffs depends on multiple factors, including their scope, duration, and how trading partners respond. As a result, proposals that rely on tariffs as a primary revenue source are often subject to careful scrutiny.

The Idea of a National Dividend

The concept of distributing government revenue directly to citizens is not entirely new. Similar ideas have appeared in various forms, such as tax rebates, stimulus payments, and resource-based dividends like Alaska’s Permanent Fund.

In Trump’s proposal, the dividend would reportedly exclude high-income earners, suggesting a targeted approach aimed at middle- and lower-income households. However, specific income thresholds, eligibility criteria, and payment mechanisms have not been outlined.

Without a detailed plan, it remains unclear whether such payments would take the form of direct checks, tax credits, reductions in healthcare costs, or another method entirely.

Questions About Implementation

One of the central challenges facing the proposal is implementation. Establishing a nationwide dividend would require legislative approval, administrative infrastructure, and clear rules regarding funding and distribution.

Key questions include:

-

How much revenue tariffs would realistically generate on a sustained basis

-

Whether tariff income would be stable enough to support recurring payments

-

How eligibility would be determined and verified

-

What impact the policy might have on prices, trade relationships, and inflation

Until these questions are addressed, the proposal remains an idea rather than an actionable program.

Supporters’ Perspective

Advocates of tariff-based revenue argue that the United States has significant leverage as one of the world’s largest consumer markets. From this perspective, tariffs are seen as a way to encourage fairer trade practices while strengthening domestic economic outcomes.

Supporters also emphasize the appeal of direct financial benefits. A dividend or rebate can feel more immediate and tangible to households than broader policy changes, particularly during times of economic uncertainty.

In public statements, Trump has framed tariffs as a mechanism for national strength and economic independence, suggesting that they can coexist with low inflation and strong market performance under certain conditions.

Criticism and Economic Concerns

Critics, however, caution that tariffs can introduce unintended consequences. Many economists argue that import taxes often lead to higher costs for consumers, as businesses pass on increased expenses through higher prices.

There are also concerns that widespread tariffs could provoke retaliatory measures from trading partners, potentially affecting exports, global supply chains, and overall economic stability.

Additionally, relying on tariffs to fund recurring payments raises questions about predictability. Trade volumes fluctuate, and revenue from tariffs can change based on economic conditions and policy decisions.

Political Context and Timing

The proposal comes amid ongoing national discussions about economic policy, trade, and cost-of-living concerns. Ideas involving direct payments tend to attract attention because they speak directly to household finances.

At the same time, any major policy shift would require broad political support. Trade policy, in particular, often generates debate across party lines, with differing views on protectionism, globalization, and economic competitiveness.

As of now, no formal bill reflecting this proposal has been introduced, and it remains part of broader political messaging rather than an established policy agenda.

Public Reaction and Discussion

Public response to the idea has been mixed. Some individuals welcome the concept of sharing government revenue directly with citizens, while others express skepticism about whether tariffs can deliver the promised benefits without negative side effects.

Discussions on social media and in economic commentary often focus on the trade-offs involved, highlighting the balance between revenue generation, consumer costs, and international relations.

These conversations reflect broader debates about how best to support economic growth while ensuring fairness and stability.

The Importance of Policy Details

Experts consistently emphasize that the success or failure of such a proposal would depend on the details. Factors such as tariff rates, product coverage, exemptions, and the structure of the dividend program would all play critical roles.

Without a clear framework, it is difficult to assess the long-term implications or determine how the policy would interact with existing tax and spending systems.

Careful analysis, modeling, and legislative debate would be necessary before any similar plan could be implemented.

Conclusion: An Idea That Sparks Conversation, Not Yet Policy

Former President Trump’s suggestion of funding a nationwide dividend through tariffs has added a new dimension to ongoing discussions about trade and economic policy. While the idea appeals to those who favor direct financial benefits and assertive trade strategies, it also raises important questions about feasibility, economic impact, and execution.

At present, the proposal remains a conceptual outline rather than a defined policy. Whether it evolves into formal legislation will depend on political will, economic analysis, and public debate.

As with any major economic initiative, informed discussion and careful consideration of both potential benefits and risks will be essential. Until clearer details emerge, the proposal serves primarily as a catalyst for conversation about how trade policy and public finance intersect in shaping the economic future of the country.

Looking at past U.S. economic policy provides useful context for evaluating proposals like a tariff-funded dividend. While no nationwide program has directly tied import taxes to universal cash payments, there are historical examples where government revenue streams have been partially redistributed to the public.

The most frequently cited example is Alaska’s Permanent Fund Dividend, which distributes a portion of state oil revenues to residents each year. Although structurally different from tariffs, the model demonstrates how resource-based income can be transformed into direct payments. Supporters of similar ideas often point to this program as evidence that dividend-style policies can gain long-term public acceptance when clearly structured and transparently managed.

At the federal level, direct payments have typically taken the form of tax rebates or stimulus checks, particularly during economic downturns. These initiatives were funded through general revenues and borrowing rather than a dedicated tax stream, highlighting how unusual — though not unprecedented — the concept of earmarked funding would be.

Administrative and Legal Considerations

Implementing a tariff-backed dividend would also involve significant administrative planning. Federal agencies would need to establish systems to track tariff revenue, determine eligible recipients, and distribute payments efficiently. Coordination between the Department of the Treasury, U.S. Customs and Border Protection, and the Internal Revenue Service would likely be required.

Legal experts note that Congress would play a central role in authorizing such a program. Under the U.S. Constitution, taxation and federal spending powers rest with the legislative branch, meaning any dividend plan would require approval through legislation. This process would include hearings, economic analysis, and negotiation over budgetary priorities.

Additionally, policymakers would need to determine whether tariff revenue would be dedicated exclusively to dividends or shared with other federal programs. This decision would influence the sustainability and scale of any payments.

Broader Economic Implications

From a macroeconomic perspective, economists would examine how direct payments funded by tariffs might affect consumer behavior, inflation, and economic growth. While additional income could support household spending, higher import costs might offset some of those gains.

Experts emphasize that outcomes would vary depending on the structure of the tariffs, the responsiveness of global markets, and how businesses adapt. These variables underscore why detailed modeling and pilot studies are often recommended before large-scale implementation.

Ongoing Debate and Future Outlook

Ultimately, the proposal reflects a broader debate about how governments can balance trade policy with domestic economic support. As economic conditions evolve and political priorities shift, ideas like tariff-funded dividends may continue to surface in policy discussions.

Whether or not this specific concept moves forward, it highlights growing public interest in innovative approaches to economic distribution and the role of trade policy in shaping national prosperity.